Retirement Income Planning Advice - IPCC Corporate

Retirement income - Top Banner

Life your way,

you've earned it.

Pay yourself back with the right retirement

income planning advice.

Retirement Income - Second Slice

What will you start in retirement?

We see retirement as a new beginning, with more time for new adventures, new ventures, new opportunities, and new ways to give back.

Yet, approaching retirement can feel unsettling, especially when you have unanswered questions about how your investments will support your lifestyle.

We’ve got answersRetirement Income - Third Slice

Take control of your retirement income

The right advice – from an advisor who truly knows you – can make all the difference.

Our advisors can answer your questions, give you advice and work with you to create a retirement income plan that targets your goals - so you can retire confidently.

What clients are saying

Retirement Income Maximize Income

If you're worrying about your retirement income,

you're not alone.

Looking out over the next 10 - 15 years

70%

of Canadians nearing retirement are

worried about their retirement strategy

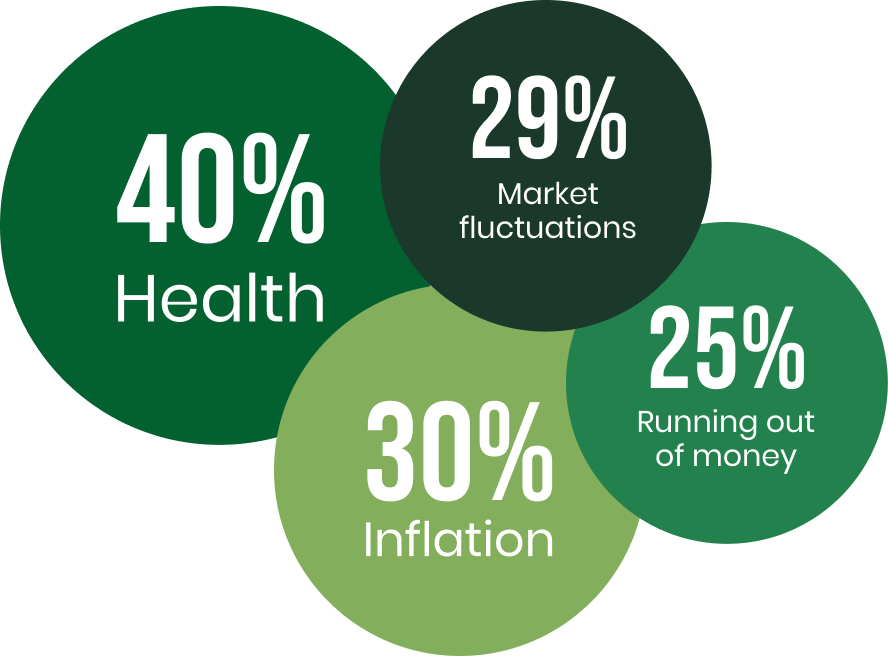

When thinking about their retirement income plan,

investors are most concerned about:

Retirement Income Create a Life slice

THE RIGHT ADVICE

Expert guidance throughout your retirement

With comprehensive analysis and experience, our advisors can help you maximize your retirement income streams with the right combination of investment and risk management strategies.

With an IPC Advisor by your side, you have a partner-in-planning who will answer all your questions, including:

How much you will need in retirement depends on various factors, including your age at retirement, desired retirement lifestyle and portfolio strategy, and expected returns.

Age at Retirement & Life Expectancy

Desired Retirement Lifestyle

Projected Sources of Income

Current or Expected Health Condition

Expected Inheritance

Portfolio Strategy & Investment Returns

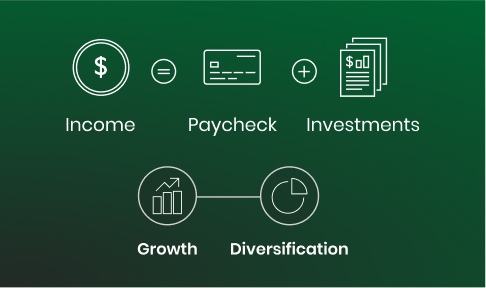

There are various possible sources of income that may impact your retirement savings. It’s important to understand each of your income sources, how much you can expect from them, and how the combination of your income streams will sustain you throughout retirement. Your income sources may include:

Private Pension

RRSP / RRIFs

Non-registered Savings

CPP or QPP and OAS

TFSAs

Inheritance

Home Equity

First, consider all your different income sources. Then design a plan that allows you to maximize the amount of income you withdraw from each source using the most effective and tax-efficient way possible.

When moving from accumulating wealth to drawing income from your portfolios, your investment objectives and strategy will evolve. Retirement income portfolios place more emphasis on generating income for the short-term while growing and protecting capital over the longer term.

Accumulation phase

Decumulation phase

There are various factors that can influence your income plan in retirement, including interest rates, how you time withdrawals, pension regulations or unexpected life events. They include:

Historically Low Rates

Low interest rates are forcing many to consider higher-risk alternatives.

Timing of withdrawals (sequence of returns)

Withdrawals made during market downturns could erode your savings faster than anticipated.

Pension Rules

The rules for CPP and OAS could mean working past age 65.

A sudden life event

Divorce, dealing with aging parents, sudden illness or disability can alter your income needs.

It’s important to assess these and other factors that are specific to you when building your plan.

Retirement Income Testimonial

I couldn’t have made this significant change without Midori. I am all settled into my new apartment, and I have peace of mind that I can afford the additional costs that come along with being in a place like this – which means I can enjoy my time here.

Audrey J., | Read Audrey's Story

“It is a balancing act to develop a plan when you face significant changes in a short time. Retirement income planning should start early with on-going dialogue with your so you to adapt your plan to meet life’s transitions.”

Midori Hillis, BA, CFP, Senior Financial Advisor,

Investment Planning Counsel, Victoria, B.C

Julia’s planning helped us understand the benefits of addressing our retirement tax liabilities. It’s an area we had not considered before working with her. Overall, we believe this has saved us and our future estate tens of thousands of dollars.

Barry & Barb G., | Read Barry & Barb's Story

“As a planner, my job is to listen very well to what my client’s priorities are and help them steer their plans and maximize all opportunities available to them.”

Julia Easey, CFP,

Investment Planning Counsel, Simcoe, ON

Working with Doug has shown me how retirement has an emotional side as well as a financial side, and it’s important to take care of both.

Pauline D., | Read Pauline's Story

“The key to working with a planner is the advice you get on an ongoing basis. It’s important to understand all the ins and outs before you take action. That’s where a planner can help.”

Doug Hopkins, CFP,

Investment Planning Counsel, Milton, ON

Dean showed me how all the different parts of my retirement income could fit together to meet my needs. I’ve been his client for more than ten years now, and I trust his advice completely. Before I started working with Dean, I thought that retirement was probably many years away for me. His know-how made my early retirement goal work!

Sarah, | Read Sarah’s Story

“If you understand the rules that can impact future income, taking tax into account, a client like Sarah can be set up to enjoy the retirement they want earlier than expected. I call this a ‘tax-smart lifestyle.”

Dean Lewis, CFP, Financial Advisor,

Investment Planning Counsel, Abbotsford, B.C

Get Better Advice Container

LIFE YOUR WAY, YOU’VE EARNED IT.

Knowing you have a plan in place that pays you back makes this time of life that much sweeter.

Get Better AdvicePowered By Counsel & PW

Powered by

COUNSEL | PORTFOLIO SERVICES

&

IPC PRIVATE WEALTH